If you’re starting a new business, or simply want to get serious about how you run your current small business, then creating a smart marketing budget is a vital step. These pointers can help you identify costs, and most importantly, help you be realistic about how you plan, budget, and adapt throughout the year.

If you’re starting a new business, or simply want to get serious about how you run your current small business, then creating a smart marketing budget is a vital step. These pointers can help you identify costs, and most importantly, help you be realistic about how you plan, budget, and adapt throughout the year.

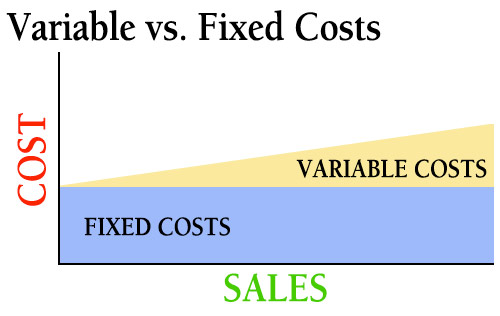

We’re going to extend this article beyond creating a marketing budget on paper, and take into account a more tangible example. This will make it easier to show budget categories, particularly the fixed costs vs. variable costs for your business. More importantly, we want to understand exactly what sort of impact they should have in your overall budgeting process.

The intent of the below example is to give you a general impression and feel for how to categorize your marketing costs, then we’ll work on guidance and tips to help you build a smart marketing budget that can adapt as your needs do.

Variable vs. Fixed Costs

Fixed costs are just that: they don’t change (or rather, they are highly predictable and are not directly related to the number of customers you have). They are not impacted by, nor have anything to do with the cost of goods sold (how much it actually cost you to make a sale).

Fixed costs are just that: they don’t change (or rather, they are highly predictable and are not directly related to the number of customers you have). They are not impacted by, nor have anything to do with the cost of goods sold (how much it actually cost you to make a sale).

Traditionally, fixed costs are: utilities, lease payments, payroll (mostly), insurance, etc. Your lease cost will not increase because you get a few more customers, unless you lease cloud space and always expand or contract based on your customer count. Some people will set a marketing budget for the year and call that lump sum a “fixed cost” because they don’t plan on changing it – personally I disagree with that approach and prefer focusing on conversions, but it is not uncommon, nor is it entirely wrong.

To identify fixed vs. variable costs, let’s look at a vocational school example: if you have a class of 15 students, vs. a class of 20, then the employee cost (your one teacher for that class) remains the same. But if you get 40 students, then you’ll probably have to hire another teacher and split the class into two classrooms. That makes teachers and classrooms “mostly” fixed costs, because they jump (in this case double) when you have to split into two classes.

On the other hand, textbooks for each student is a prime example of a variable costs. If the class goes from 15 to 20 students you still have one teacher, but you do need to buy enough additional textbooks to cover every student in the class (same with general classroom supplies). In marketing, you might have post-purchase satisfaction programs that would therefore be a variable cost because they fully depend on how many customers you’ve won in any reporting period.

Fixed costs in marketing are often resources that you use to deploy or create materials, and the people costs to sell the goods. If employees are on wages or salary (not commission), then some of your payroll is a fixed cost. The computers used to create a flyer is fixed, because it doesn’t cost you more to design 10 flyers vs. 100 flyers. Maybe you have a monthly subscription to an email service that doesn’t charge based on the number of emails sent – that would also be fixed.

Variable marketing costs are those directly proportional to volume. As in the flyer example above, the cost of printing and mailing 10 flyers vs. 100 is very different. Even though you can plan for a specific amount in your budget, which therefore makes it sometime “fixed”, in a smart marketing budget, you still want to leave yourself some room (more on that below).

A Flexible Marketing Budget is a Smart Marketing Budget

Marketing budgets can be shifty and difficult to discretely categorize.

Marketing budgets can be shifty and difficult to discretely categorize.

The must be.

Of all the budgets in your business, your marketing should be one of the most flexible so that it can quickly adapt to unforeseen needs and opportunities. You can view most of it as fixed and pre-allocated costs if you build a marketing budget based on previous year’s revenue – but then you might get stuck or miss good opportunities.

For this reason I like to look at marketing budgets based almost entirely on conversions: how much does it cost to get a customer, rather than how much can I spend for the year. Marketing can also fall under a discretionary category for sponsorships, PR, bonuses, charitable donations, etc. Bottom line: if anything should have wiggle room, it’s your marketing budget, because without new customers, your budgets for everything else won’t exist anymore.

Be Realistic When Creating Your Marketing Budget

The above is intended to give you a “feel” for how to categorize your marketing costs as well as place them within the overall picture. To actually create a marketing budget, however, you need to be realistic. It’s nice to be optimistic about your sales, and feel that you can run “big time sales” effectively on small budget, but please… be realistic. And above all else: allow room for uncertainty. (Yes, it is strange to meet a realist who also happens to do marketing – normally all “marketing people” promise you the moon – but I think it’s important to be able to get back from the moon in one piece, too. )

First: analyze your previous years and look for areas where you see spending vs. return thresholds being crossed on your variable costs. Imagine two lines on a graph (direct / variable costs and revenu). Are there any categories that demonstrated a ceiling or a plateau? Is there a point where the line for the increasing cost started to stray above or too close the revenue line? This sort of occurrence It happens a lot in advertising spending in regards to frequency: how many times does a person need to see an ad before the additional impressions become moot or ineffective? Knowing those thresholds for all your marketing categories is a huge help to direct how much you should therefore budget for each category.

If you don’t know where these marketing cost plateaus are: find them (and they do change, which means it’s something to test often). Like anything else, if you’re not experimenting and failing every now and again, then you’re not doing your job well. Push the limits is a perfectly safe business practice IF AND ONLY IF you are being smart about tracking the results, so that when you hit spending ceilings you know it and don’t waste much money.

If you don’t know where these marketing cost plateaus are: find them (and they do change, which means it’s something to test often). Like anything else, if you’re not experimenting and failing every now and again, then you’re not doing your job well. Push the limits is a perfectly safe business practice IF AND ONLY IF you are being smart about tracking the results, so that when you hit spending ceilings you know it and don’t waste much money.

You want to budget for realistic growth. Customers help you grow, but they also mandate you use more resources to serve them, which, in turn, demands you’re able to maintain at least that level of new customers or else your service suffers and your business tumbles under its own weight – success for a small business is a blessing and a curse in that way.

You can increase your profits by cutting some of your fixed costs, but that can create additional stress on your business that might hurt you in the end. Cut your costs where you can, protect your staff and keep them happy, and always use your customer conversion data to estimate how much MORE you might need to spend in order to win the number of customers you need to support business growth. Projections are OK, but knowing what it takes because you have good conversion data is the best.

Modest cost cutting coupled with intelligent spending to increase sales is always a good model to follow. Being “bold” and drastic in either area can get most businesses into trouble – not all of us can simply ask angel investors for another few million dollars when we get into trouble.

Take a step back. It’s very easy to get lost in the numbers, especially if you lean to either extreme of being safe or overly optimistic.

Analyze your budget both by category as well as a whole. Compare the ratios to previous year’s actual numbers. It’s perfectly fine of the percentages are different so long as there is a plan and reason as to why your business budget has changed in that area. Creating your budget is a step in creating your plan for the year. Every piece should reflect your business goals and projects you have planned. Your budget should tell the story of the year to come (less the unexpected, but as mentioned above, budget for that as well).

Be safe by being taking smart risks. Creating your budget will help you organize and plan for the future as well as be a visual way to show you if your plans are viable. Work smart. You can be a rock start and go budget-less next time.